All knowledge

Overview with current news, in-depth knowledge, and practical insights into the field and the environmetalchallenges we are closely connected to.

Articles

Article

Mass Objection Procedure on Corporate Income Tax Interest: What Happens Now and When?

27 February 2026 -

In an earlier blog, we wrote about the Supreme Court ruling that ruled that the increased corporate tax interest rate[1] is non-binding. This put an end to the...

Article

Coalition agreement 2026: fiscal highlights and key takeaways

3 February 2026 -

On January 30, 2026, D66, VVD, and CDA presented their coalition agreement: Aan de slag – Bouwen aan een beter Nederland ("Getting to Work – Building a Better...

Article

Escalation in the event of a governance deadlock: summary proceedings or inquiry?

2 February 2026 -

Governance conflicts in 50/50 partnerships can escalate rapidly. When directors share joint authority and cooperation breaks down, the company risks falling...

Article

Design law: the legal requirements for protection of EU designs

8 January 2026 -

At the end of 2025, the European Court of Justice presented a new judgment concerning the protection of designs, which is particularly important for rights...

Article

When is the Defense and Security Procurement Act applicable to grid operators?

29 December 2025 -

On January 1, 2026, the Dutch Energy Act (in Dutch) will enter into force. This law means that grid operators will have to procure certain contracts under the...

Article

The Digital Omnibus: Implications for AVG, Data Act & AI Act

10 December 2025 -

The European legislator wants to draw a line under many digital regulations. The Digital Omnibus is essentially a major maintenance of the European digital...

No posts found

Client cases

Breakthrough for orthopedic shoe technology industry in cases against health insurers VGZ and CZ

4 December 2024 -

Providers in this sector have recently successfully fought in two separate summary proceedings against health insurers VGZ and CZ for real, cost-covering rates....

Dirkzwager assists Info Support and limits claim to 3%

19 September 2024 -

Dirkzwager successfully assisted Info Support in a legal dispute, reducing the original claim to just 3%.

Dirkzwager guides HAN in crisis management after data breach

19 September 2024 -

When HAN was hit by a hack in 2021 that led to a data breach, Dirkzwager assisted them with expert advice on privacy legislation. Dirkzwager provided calmness...

Cooperation between Katalys and Dirkzwager helps resident initiatives professionalize and realize plans

12 September 2024 -

Residents who want to improve their neighborhoods often discover that legal advice is very useful and necessary for their projects. Regulations are becoming...

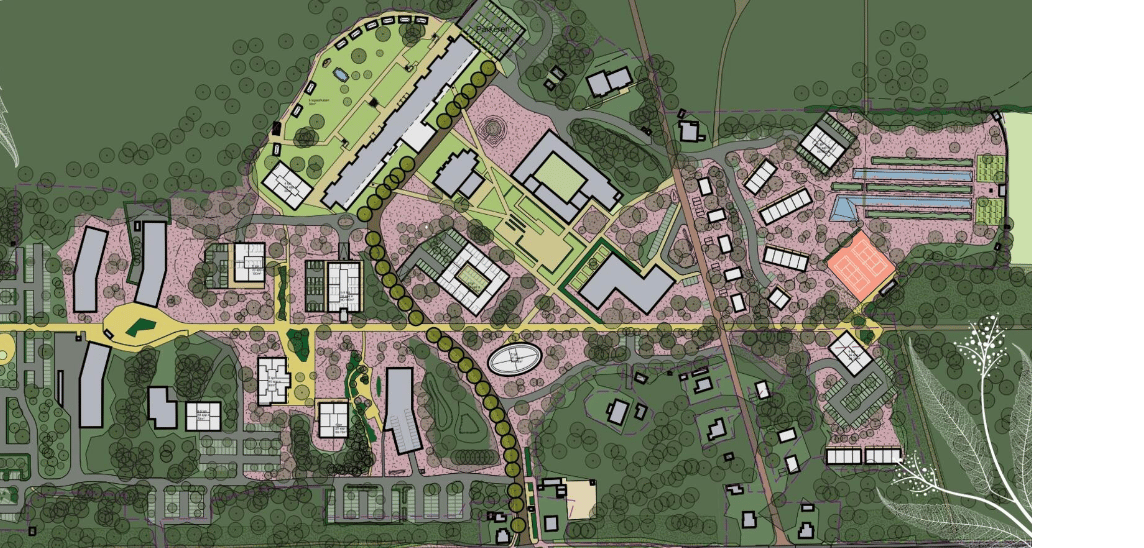

Transformation Dekkerswald: From care facility to caring neighborhood

12 September 2024 -

ZZG Zorggroep is transforming Dekkerswald into a caring neighborhood with 395 housing units, from sale to rental. Dirkzwager is providing legal guidance for...

Successful collaboration in the conect4children project

12 September 2024 -

Conect4children is a large European collaboration with the aim of facilitating the development of new drugs and other therapies for the entire paediatric...

No posts found