All knowledge

Overview with current news, in-depth knowledge, and practical insights into the field and the environmetalchallenges we are closely connected to.

Articles

Article

Abolition of Pledge Prohibitions Act

2 July 2025 -

The Senate has passed the Abolition of Pledge Prohibitions Actand its effective date is known, which is July 1, 2025. The Act has an impact on how parties can...

Article

Key differences between trade mark and trade name protection

28 April 2025 -

Trade marks and trade names offer businesses protection against unauthorized use of identical or similar signs to such marks and names, but they are subject to...

Article

Limiting vendor lock-in: how do you maintain freedom and flexibility in a digital world?

11 April 2025 -

In an increasingly digital world, we rely on numerous third-party vendors for their software, cloud solutions and other IT services. This collaboration often...

Article

Intellectual Property in the Netherlands and the EU: Development, Ownership and Exploitation

7 April 2025 -

Technological advancement and globalization have dramatically changed the world economy. These developments continue to have a material impact on value chains,...

Article

Personal Security under Dutch Law: Suretyship & Guarantees

3 April 2025 -

In our last month’s blog we introduced the various types of security interests under Dutch law. Under Dutch law, obligations (claims) can be secured by...

Article

Platforms of dominant companies and mandatory interoperability: Important ruling by the CJEU on Android Auto

31 March 2025 -

On 25 February 2025, the Court of Justice of the European Union (CJEU) issued an important preliminary ruling in the case between Alphabet (Google) and the...

No posts found

Client cases

Breakthrough for orthopedic shoe technology industry in cases against health insurers VGZ and CZ

4 December 2024 -

Providers in this sector have recently successfully fought in two separate summary proceedings against health insurers VGZ and CZ for real, cost-covering rates....

Dirkzwager assists Info Support and limits claim to 3%

19 September 2024 -

Dirkzwager successfully assisted Info Support in a legal dispute, reducing the original claim to just 3%.

Dirkzwager guides HAN in crisis management after data breach

19 September 2024 -

When HAN was hit by a hack in 2021 that led to a data breach, Dirkzwager assisted them with expert advice on privacy legislation. Dirkzwager provided calmness...

Cooperation between Katalys and Dirkzwager helps resident initiatives professionalize and realize plans

12 September 2024 -

Residents who want to improve their neighborhoods often discover that legal advice is very useful and necessary for their projects. Regulations are becoming...

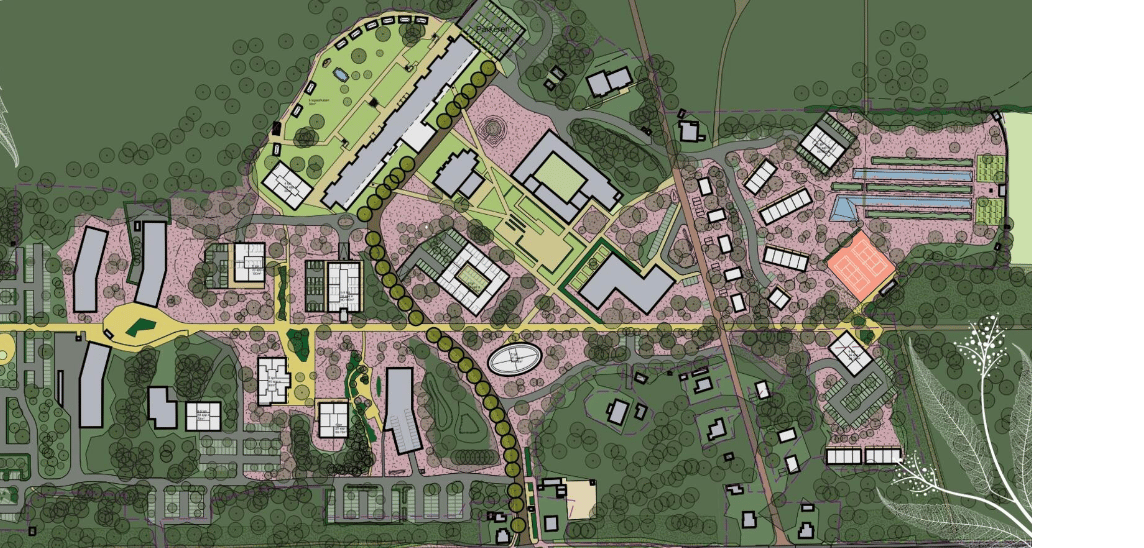

Transformation Dekkerswald: From care facility to caring neighborhood

12 September 2024 -

ZZG Zorggroep is transforming Dekkerswald into a caring neighborhood with 395 housing units, from sale to rental. Dirkzwager is providing legal guidance for...

Successful collaboration in the conect4children project

12 September 2024 -

Conect4children is a large European collaboration with the aim of facilitating the development of new drugs and other therapies for the entire paediatric...

No posts found